Guide to Reconciliation

Managing your financial documents efficiently is critical, and with RollCredits, the reconciliation of your transactions with bank statements is streamlined. Here's a step-by-step guide to simplify this process.

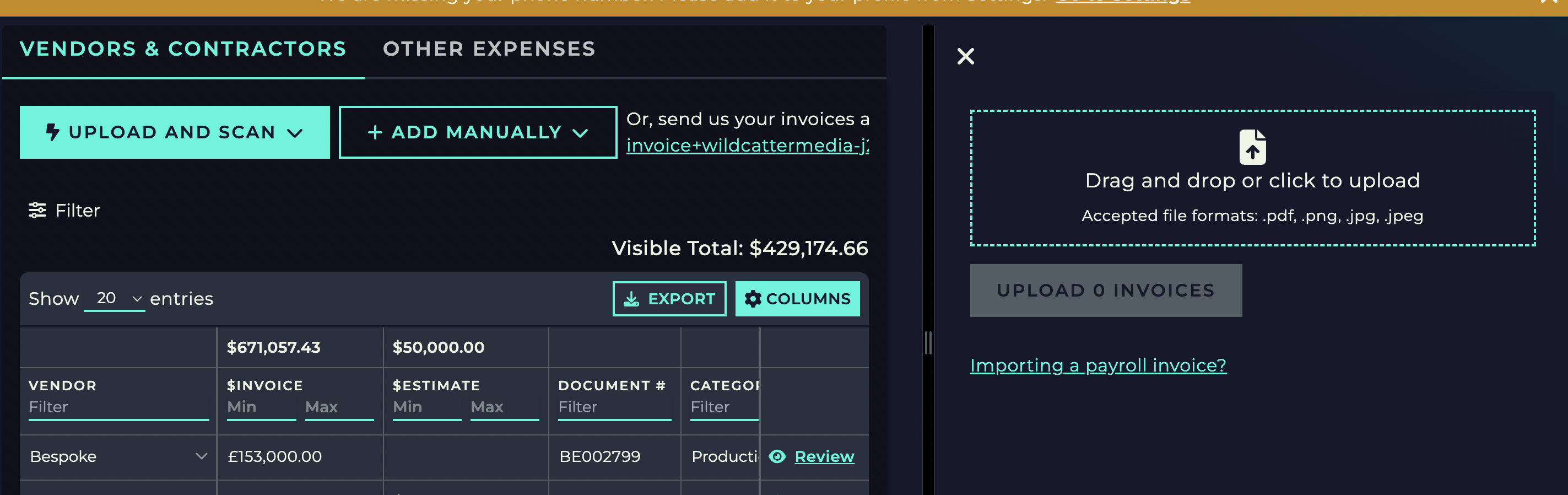

Upload Financial Documents to RollCredits

Initiate by uploading all your invoices, receipts, and estimates directly to the RollCredits platform via the transactions page. This centralizes your documents, making them ready for reconciliation.Import Credit Card Statements

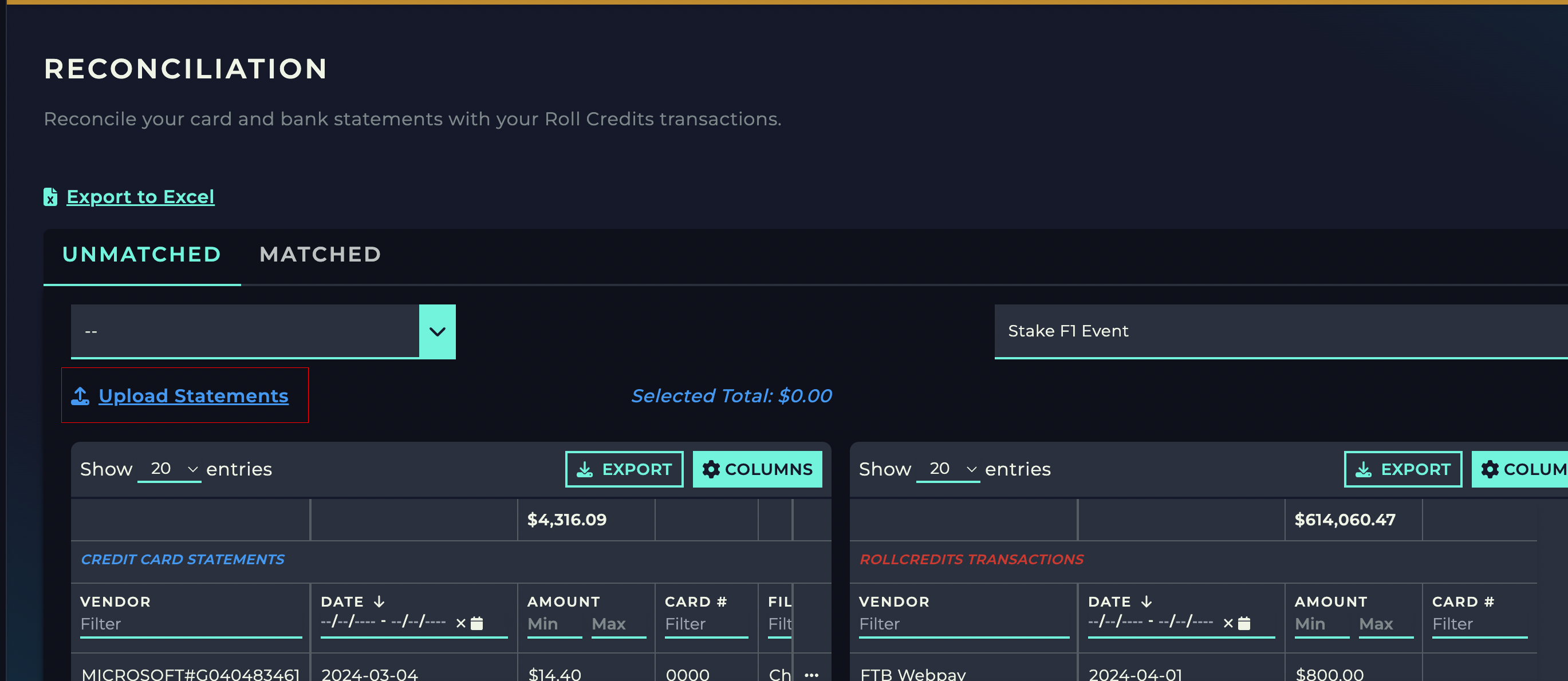

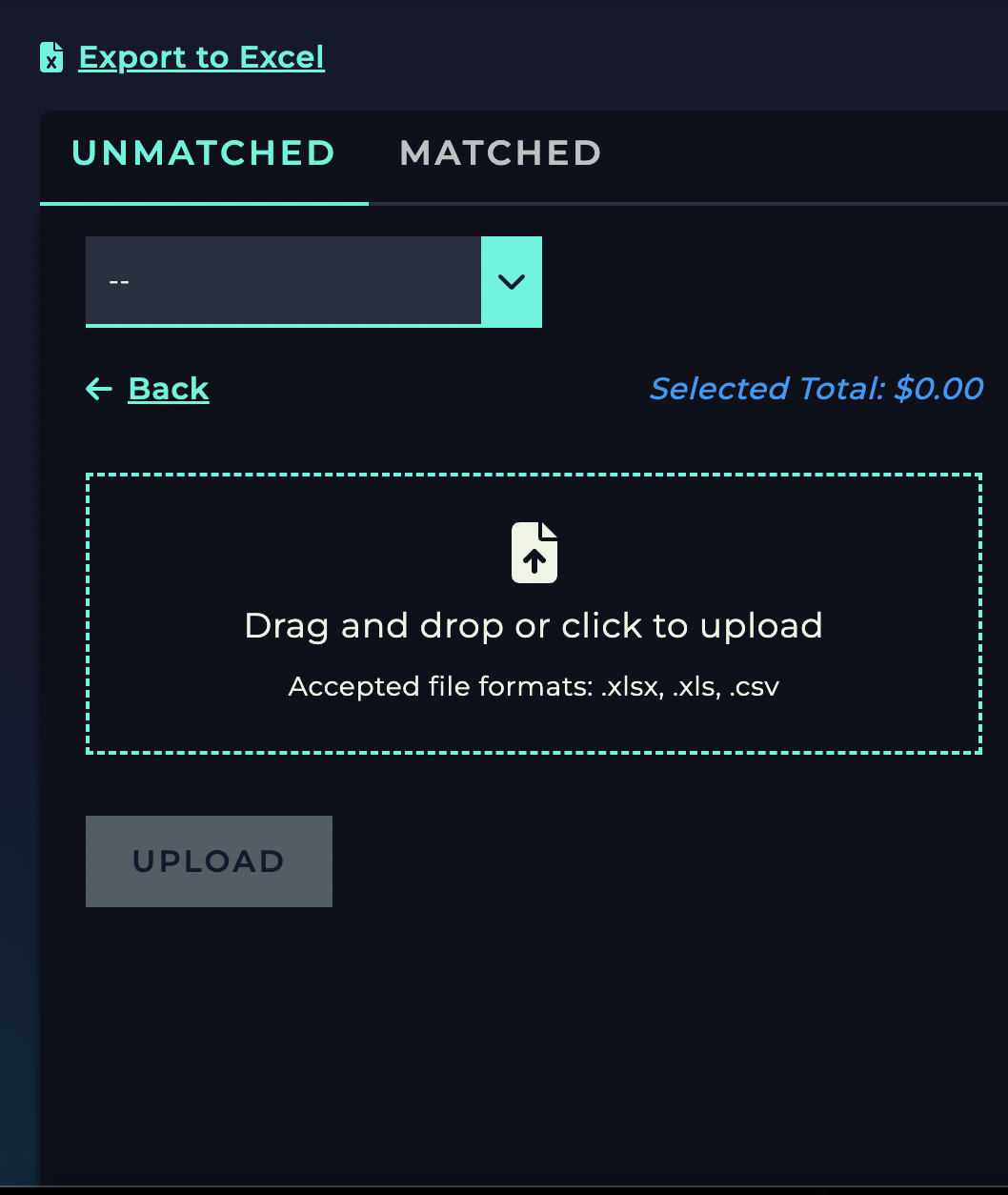

Navigate to the reconciliation page and upload your credit card statement. Our platform accepts various formats such as .xlsx, .xls, and .csv to ensure compatibility with your bank's files.Automatic AI Reconciliation

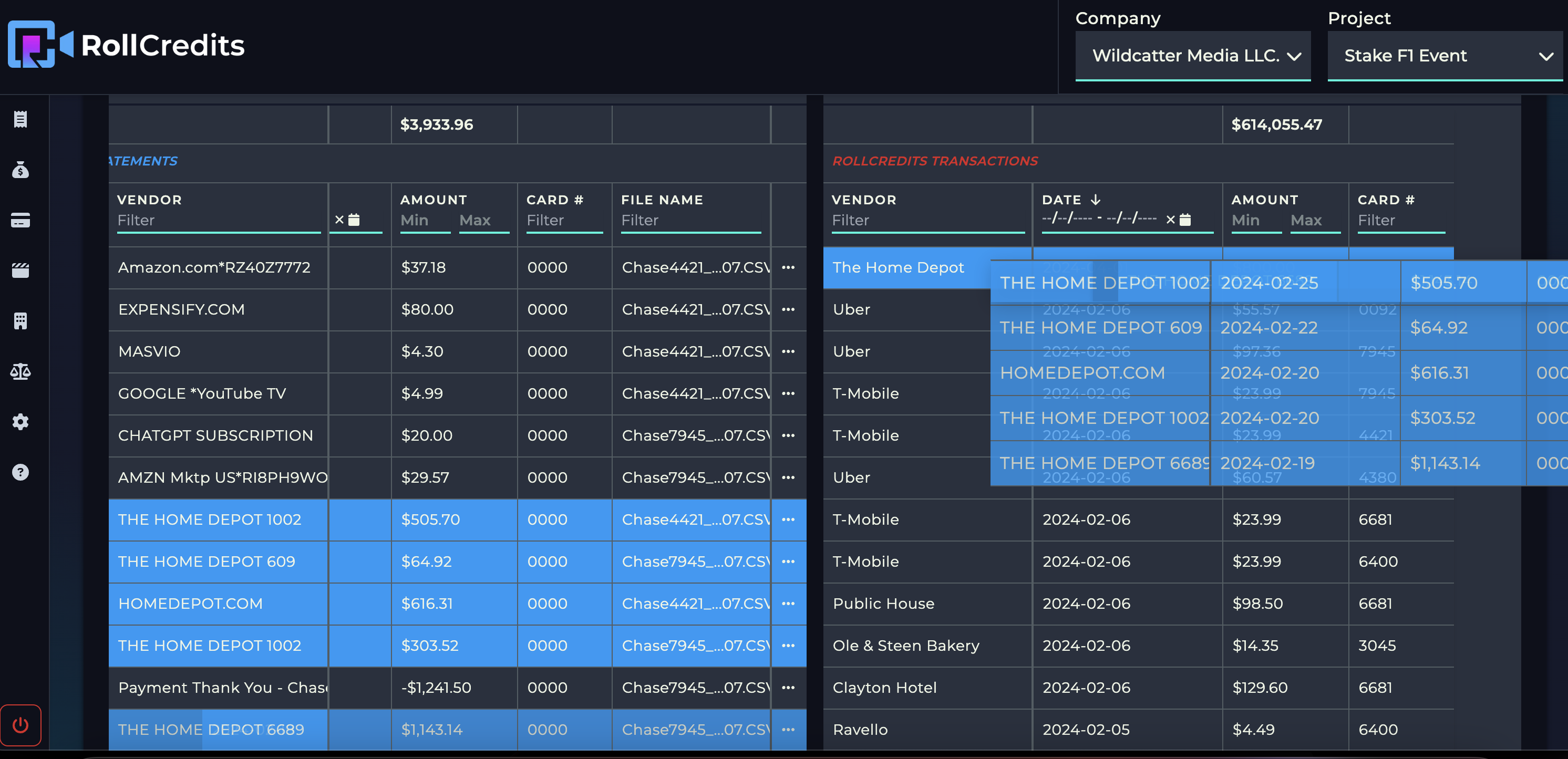

Once uploaded, our system's AI will get to work, automatically reconciling many of your transactions. This feature saves you time by matching credit card statement entries with the transactions recorded in RollCredits.Manual Matching for Unreconciled Entries

For transactions that weren’t auto-matched, you can easily drag and drop unmatched credit card transaction rows onto the corresponding RollCredits transaction entries to reconcile them manually.How-to:

Click on the credit card transaction rows on the left that you want to pair with a RollCredits transaction.

Drag them from the left table over top of the row in the right table you'd like to pair them with.

Release your mouse and the match will be complete.

You can always fix any mistakes made by unmatching them in the matched tab and then rematching them!

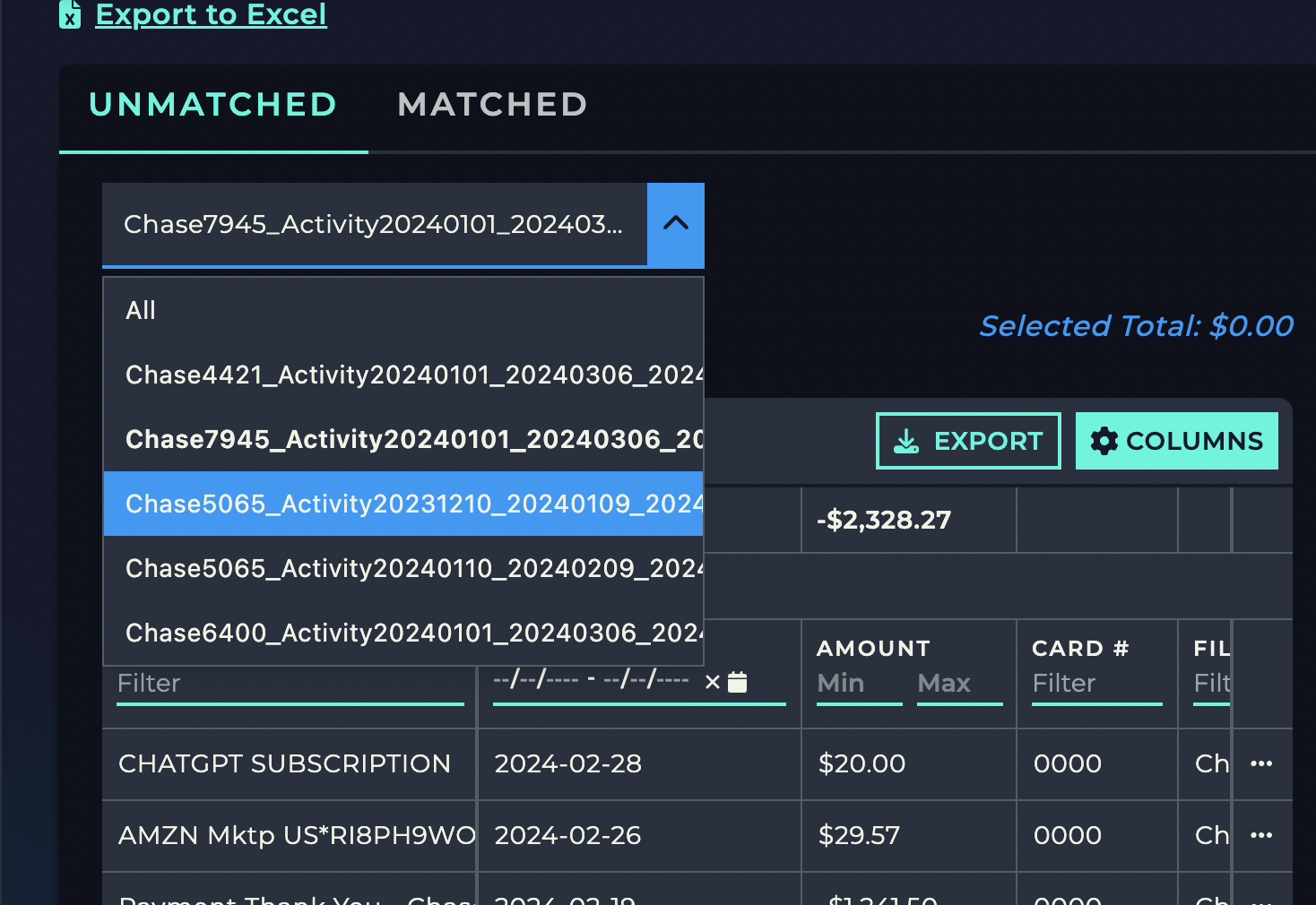

Switch Between Credit Card Statements

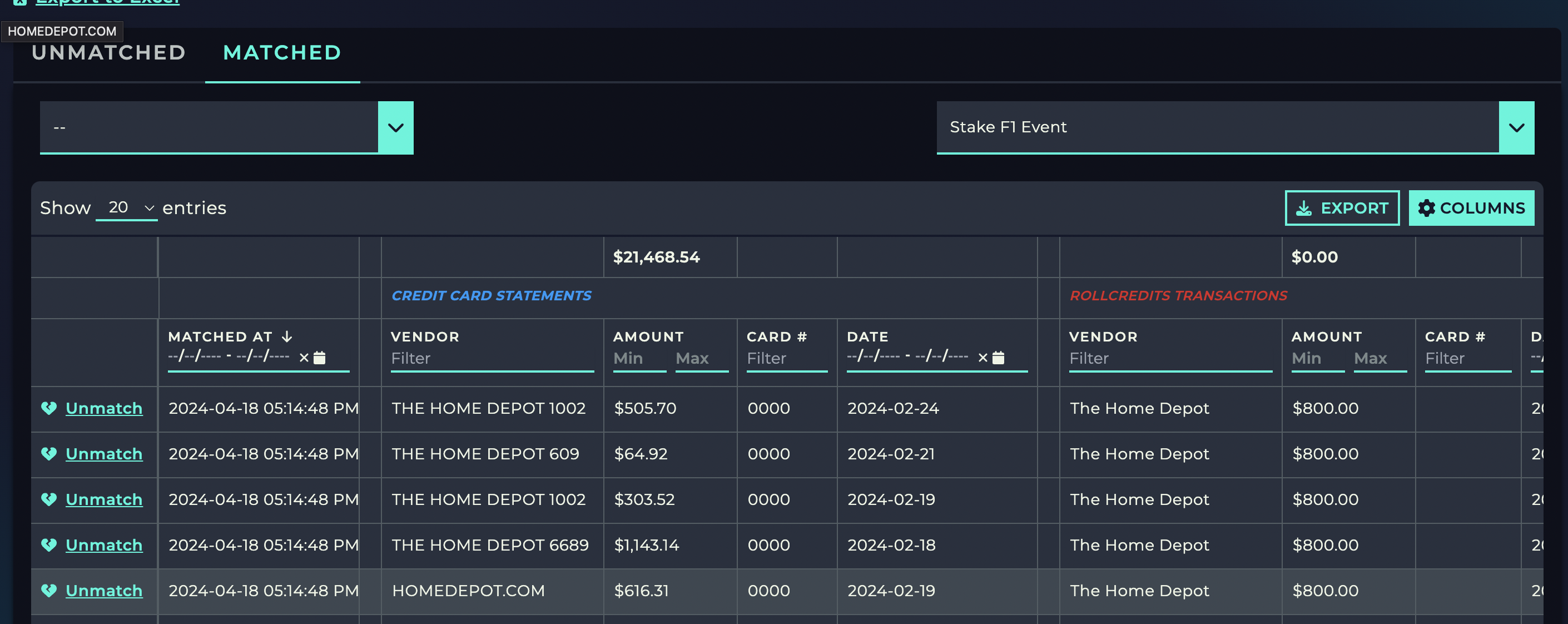

If you've uploaded multiple credit card statements, use the dropdown menu in the top left to switch between files. This allows you to reconcile transactions across different accounts and periods efficiently.Review Matched Transactions

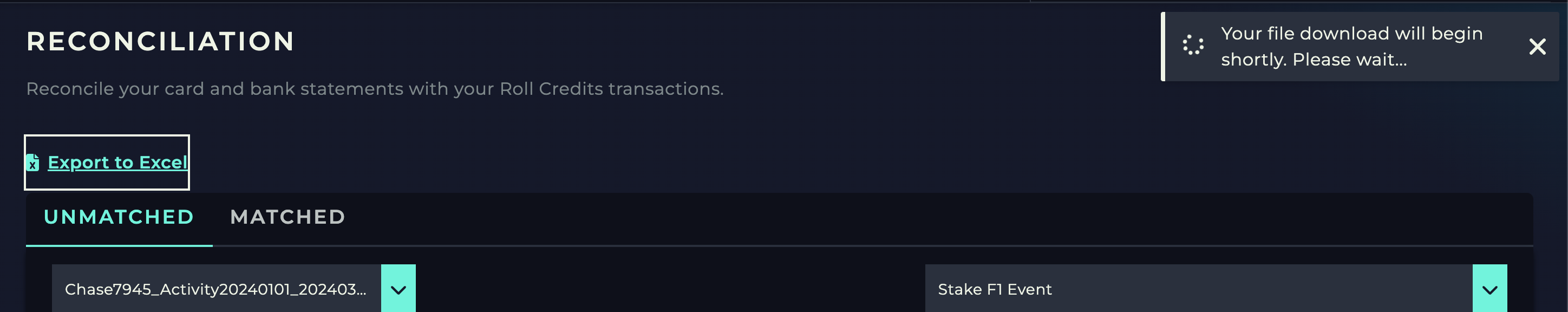

Review all your reconciled transactions under the 'Matched' tab. This tab provides a clear overview of all entries that have been successfully matched, confirming your accounts are in order.Export Reconciliation Reports

After reconciliation, you can export a detailed report of your matched and unmatched transactions. This report can serve as a record for your accounting or for further analysis.

Remember, keeping your financial records in sync is key to accurate accounting and financial reporting. RollCredits simplifies reconciliation, ensuring that your financial statements are always up-to-date and reflective of your business activities.